Stop assuming ‘declining returns’ in small charities

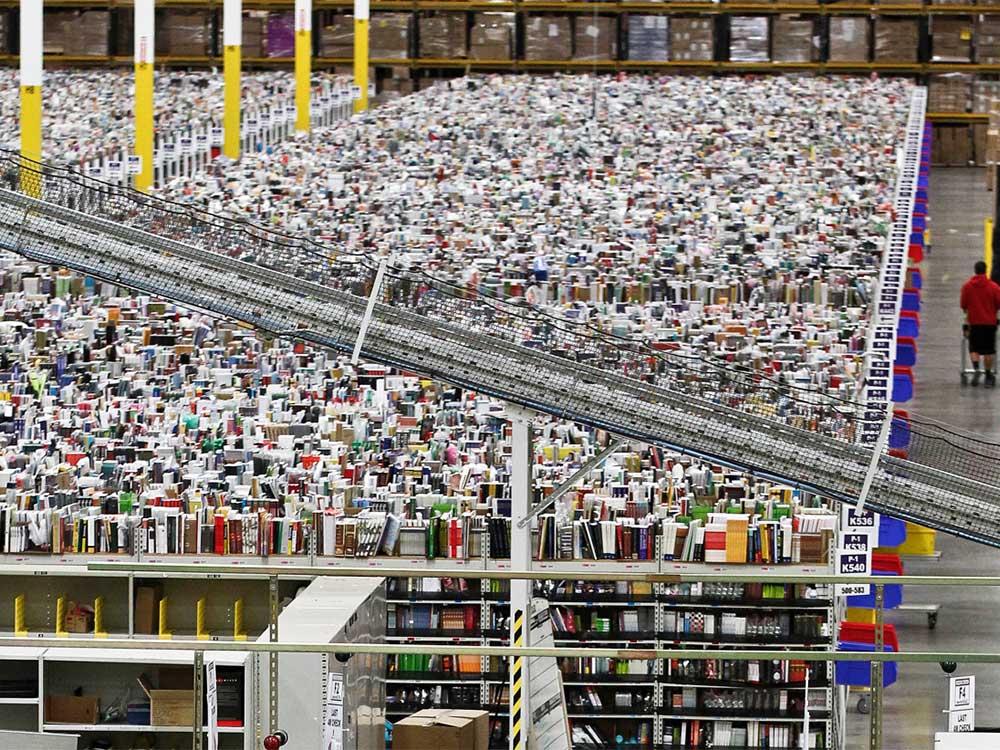

Amazon is one of the world’s largest companies and is still achieving lower marginal costs as it gets larger. Organisations with just a few people will frequently do much better as they get larger.

We often hear people in our community state, as if obvious, that becoming the 5th employee of an organisation creates less impact than becoming the 4th employee. Similarly, later donations are thought to create less impact than earlier donations. This sentiment was widespread in recent discussion about whether to donate to Giving What We Can, discussions on the EA forum about where to donate, and in discussions I’ve had with people about where to work.

The reason stated is “diminishing marginal returns”. The first staff members take the best opportunities, so the extra opportunities available at the margin are worse, so each extra staff member has less impact.

The problem is, assuming diminishing returns to small organisations contradicts basic economic theory.

According to economics, as an organisation scales up, there’s two opposing forces:

- Economies of scale.

- Diminishing returns.

Economies of scale are a force for increasing returns, and they win out while still at a small scale, so the impact of the 5th staff member can easily be greater than the 4th.

Economies of scale are caused by:

- Gains from specialisation. In a one person organisation, that person has to do everything – marketing, making the product, operations and so on. In a larger organisation, however, you can hire a specialist to do each function, which is more efficient.

Fixed costs. Often you have to pay the same amount of money for a service no matter what scale you have e.g. legally registering as an organisation costs about the same amount of time no matter how large you are; an aircraft with 100 passengers requires the same number of pilots as one with 200 passengers. As you become larger, fixed costs become a smaller and smaller fraction of the total.

Physical effects. Running an office that’s 2x as large doesn’t cost 2x as much to heat, because the volume increases by the cube of the length, while the surface area only increases by the square of the length. A rule of thumb is that capital costs only increase 50% in order to double capacity.

In our experience, there also seems like there’s psychological effects, especially social proof. Once 1,000 people have shown support for an idea, it seems less weird than when only 10 people have shown support for it, making it easier to persuade more people at the margin.

Because economies of scale win out over diminishing returns at a small scale, the production function is humped-shaped: the amount of output per unit of input initially increases, and then starts decreases when the organisation is close to saturating its market and becomes overly bureaucratic.

This means total output function is s-shaped.

What does this mean?

For a large organisation that’s nearly saturating its market and is for-profit, it’s safe to assume diminishing returns. But for a small organisation that’s rapidly growing and reaching a small fraction of its addressable market, it’s not a safe assumption. It seems even less safe for charities — the nonprofit fundraising is pretty inefficient, so there’s no guarantee that a charity will naturally fundraise all the way to the point that it hits diminishing returns.

Assuming diminishing returns for small charities would lead us to:

- Underinvest in scaling up organisations that are still small but not new.

- Overinvest in new organisations or already large organisations.

My guess is that we’re overinvesting in starting new projects relative to scaling up small ones (though we could be underinvesting in both). It seems obvious that diminishing returns don’t apply to founding new organisations, so people are keen to do this – the mistake is then to assume diminishing returns kick in after you’ve hired a couple of people rather the hundreds of people. (And of course there are biases, such as risk aversion, that push in in the other direction).

This means that we’ll end up with lots of small organisations, and no big wins. And because all the impact comes from the big wins (because the distribution of impact for new organisations has a fat tail), we’ll end up having far less impact than we could have.

Example: Giving What We Can

During GWWC’s recent fundraising, many assumed that returns are diminishing (see some discussion). But consider:

- Giving What We Can’s reach is extremely small relative to its addressable market. My guess is that taking the GWWC pledge is about as ethically demanding as being a vegetarian (i.e. involves a similar amount of sacrifice to do a similar or greater amount of good), so the number of people who take the pledge could one day be about the same as the number of vegetarians. About 1% of people in the developed world are vegetarians, so at 1,000 pledges, GWWC has only reached 0.01% of its addressable market. Even if this estimate of market size is out by a factor of 100, the basic point stands.

GWWC is growing fast. The number of pledgers increased about 100% in 2014 – and the team was small at only five people.

Many tasks have a significant fixed costs e.g. fundraising drives, operations and annual impact evaluations. This means that an increasing fraction of new staff time goes into the activities that produce new pledgers, such as talking to potential members.

There seems like there’s more room for gains from specialisation e.g. GWWC was recently looking for a ‘Director of Growth’ to focus on expanding reach.

The social proof effect seems important. Persuading the first 1% of students in a university seems harder than persuading the second percent, because by then it’s more normalised, and having local volunteers who support you makes it easier to reach further students.

Consistent with the above, we observe that the ratio of costs to new members per year is going down.

Given this, my guess is that returns to additional staff members are indeed increasing on the current margin.